Online Shopping Trends in the UAE: Platforms and Consumer Behavior

Online shopping in the UAE has witnessed rapid growth in recent years, driven by high internet penetration, widespread smartphone usage, and a preference for convenience. Consumers are increasingly turning to e-commerce platforms such as Amazon.ae, Noon, and Namshi, along with social media marketplaces, to purchase everything from fashion and electronics to groceries. This shift in consumer behavior reflects not only the appeal of competitive pricing and quick delivery but also a growing trust in digital payment systems and online retail experiences.

Popular E-Commerce Platforms in the UAE

The UAE e-commerce ecosystem features a diverse range of platforms catering to different consumer needs. Noon.com, launched in 2017, has established itself as a major regional marketplace offering electronics, fashion, home goods, and groceries. The platform’s success can be attributed to its understanding of local preferences and Arabic language support. Amazon.ae (formerly Souq.com) continues to dominate with its extensive product range, competitive pricing, and reliable delivery services.

Specialty platforms have also gained significant traction in the UAE market. Namshi focuses exclusively on fashion and has built a loyal customer base through curated collections and frequent promotions. Carrefour and Lulu Hypermarket have developed robust online grocery shopping services, allowing customers to receive fresh produce and household essentials directly to their doorsteps. For electronics, Sharaf DG and Jumbo Electronics have established comprehensive online stores complementing their physical retail presence.

Factors Influencing Consumer Behavior

Several key factors drive online shopping decisions among UAE consumers. Payment security remains paramount, with shoppers showing strong preferences for platforms offering secure transaction methods and buyer protection policies. Cash on delivery remains popular despite the growth of digital payment options, reflecting persistent concerns about online fraud among certain consumer segments.

Product authenticity significantly influences purchase decisions in the UAE market, where counterfeit goods remain a concern. Established platforms with verification processes and direct brand partnerships tend to attract more trust. Additionally, delivery speed and reliability have become critical differentiators, with consumers increasingly expecting same-day or next-day fulfillment options, particularly in urban centers like Dubai and Abu Dhabi.

Price sensitivity varies considerably across product categories and consumer demographics. While luxury goods maintain strong demand regardless of price point, everyday items face more competitive pricing pressures. The proliferation of price comparison tools and deal aggregators has empowered UAE consumers to make more informed purchasing decisions, driving competitive pricing across platforms.

Shopping Behavior Patterns Across Demographics

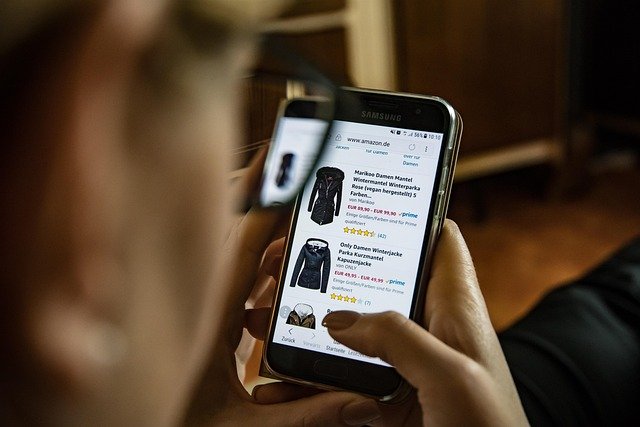

Shopping behaviors in the UAE demonstrate interesting variations across different demographic segments. Younger consumers (18-34) show greater comfort with mobile shopping, completing the entire purchase journey from discovery to checkout on smartphones. This group also demonstrates higher engagement with social commerce, purchasing directly through Instagram and Facebook.

Expatriate residents, who comprise a significant portion of the UAE population, often exhibit shopping patterns influenced by their home countries while adapting to local options. Many maintain purchasing relationships with international retailers while simultaneously embracing UAE-based platforms. This creates a unique cross-border shopping ecosystem where global and local commerce intersect.

Emirati nationals typically demonstrate strong brand loyalty when shopping online and show particular interest in luxury goods, premium electronics, and exclusive products. This segment values personalized shopping experiences and premium delivery options, with less price sensitivity than other demographic groups.

Future Trends in UAE Online Shopping

The integration of augmented reality (AR) into the online shopping experience represents one of the most promising developments in the UAE e-commerce landscape. Furniture retailers and cosmetics brands are pioneering AR applications that allow customers to visualize products in their own spaces or on themselves before purchasing. As this technology becomes more sophisticated, it promises to bridge the gap between physical and digital retail experiences.

Voice commerce is gaining momentum as smart speaker adoption increases across UAE households. Platforms are developing voice-activated shopping capabilities that allow customers to place orders through simple verbal commands. This technology is particularly appealing in the UAE’s multicultural environment, as advances in natural language processing continue to improve support for Arabic and other regional languages.

Sustainability concerns are increasingly influencing online shopping decisions in the UAE. Consumers are showing greater interest in eco-friendly products and packaging, with many willing to pay premium prices for environmentally responsible options. E-commerce platforms are responding by highlighting sustainable product choices and implementing greener delivery practices, including electric vehicle fleets and packaging reduction initiatives.

Marketplace Performance Comparison

The competitive landscape among UAE e-commerce platforms reveals interesting patterns in market positioning and consumer preferences.

| Platform | Market Share | Product Categories | Delivery Speed | Special Features |

|---|---|---|---|---|

| Noon.com | 25-30% | General merchandise | Same-day to 3 days | Arabic interface, local brands focus |

| Amazon.ae | 30-35% | General merchandise | Same-day to 3 days | Prime membership, international brands |

| Namshi | 10-15% | Fashion, accessories | 1-4 days | Try-before-you-buy, fashion focus |

| Carrefour Online | 8-10% | Groceries, household | Same-day to next-day | Fresh produce, store integration |

| Noon Grocery | 5-8% | Groceries, fresh food | 1-2 hours to next-day | Express delivery options |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Conclusion

Online shopping in the UAE continues to evolve rapidly, driven by technological innovation, changing consumer preferences, and increasing competition among platforms. The market demonstrates sophisticated shopping behaviors across diverse demographic segments, with consumers increasingly expecting seamless experiences, authentic products, and efficient fulfillment. As emerging technologies like augmented reality and voice commerce gain wider adoption, and as sustainability becomes a more prominent factor in purchasing decisions, UAE’s e-commerce landscape will likely continue its dynamic transformation, offering new opportunities for both retailers and consumers.